- El Paso Neighborhood REALTOR®

- Home Valuation

- Commercial Real Estate El Paso Tx

- USDA Loans

- Senior Real Estate Specialist®

- Zero Down Payment Assistance Program

- No Closing Cost VA Loans

- El Paso Real Estate Blog

- New Homes for Sale - Beware!

- My Guarantee

- Selling a Home in El Paso

- First Time Home Buyer in El Paso

- Horizon City Texas Homes for Sale

- Pre-Qualification Process

- Zillow Real Estate, Realtor Review

- Find Your Dream Home

- Why RUSSELL REALTY GROUP

- VA Housing Loan El Paso

- Good Neighbor Next Door

- Neighborhood Stabilization Program

- Relocation Resources

- El Paso Home Inspectors List

- Horizon City Tx Homes For Sale

- El Paso Luxury Homes

- Best Realtor For Military Buyers

- Preparing To Buy A Home in El Paso Texas

- Home Warranty Plans

- Home Selling Q&A

- Buyer guide

- Do I need to have an inspection?

- Buying an Older Home

- Buying a HUD Home

- Buyers Agent

- Casas en El Paso Texas

- Ft Bliss Homes under $150,000

- Military Relocation

- Wills, Estates and Probate

- Agave Homes El Paso Tx

- Bella Homes El Paso Tx

- Palo Verde Homes El Paso Tx

- El Paso Tx Fort Bliss Monitor

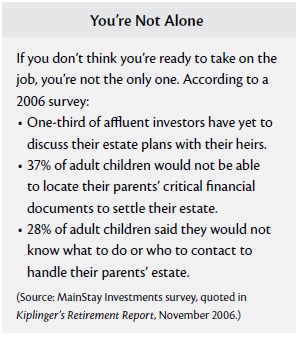

Texas Probate ProcessIntroductionWelcome to the Texas probate process, which involves several steps to settle an estate. This guide will provide an overview of each step. Step 1: Filing the ApplicationWhen initiating the probate process, the first step is to file an application with the Texas probate court. This application includes necessary documents such as the original will (if applicable), death certificate, and an inventory of the decedent's assets. Step 2: Appointment of Executor or AdministratorOnce the application is filed, the court will appoint an executor named in the will. If there is no will or executor named, the court will appoint an administrator. The executor or administrator is responsible for managing the estate throughout the probate process. Step 3: Notice to Creditors and BeneficiariesAfter the appointment, the executor or administrator must provide notice to creditors of the estate, allowing them to make claims for any debts owed. Additionally, beneficiaries named in the will and heirs at law must be notified about the probate proceedings. Step 4: Inventory and Appraisal of AssetsThe executor or administrator is responsible to provide a list of personal assets called an inventory. The executor must further appraise the deceased person's estate in 90 days of the hearing. He/she must notify beneficiaries of the will, post a notice to creditors, file the decedent's last federal tax return and settle the estate including selling the decident's real properties. Yvonne Russell, is an experienced real estate agent who has assisted many executors and family members sell estate homes. Step 5: Payment of Debts and TaxesThis part of the process is to resolve disputes including disputes with creditors, claims on the estate like mechanics liens, and otherwise settle claims against the estate. This duty may include settling disputes arrising from disagreements over the valuatio of assets and contesting a creditors' claim on the estate. The executor is considered a fiduciary which means the executor is the person who holds a legal and ethical duty to act with the hightest loyalty and fidelity. He/she takes care of the money or assets for the decident. An attorney should be consulted to represent the estate or third party interest. Step 6:Distribution of AssetsOnce debts and disputes are settled, the remaining assets are distributed to beneficiaries. Some assets pass directly to the beneficiary such as life insurance, IRA's, retirment accounts, transfer on death and a number of other assets. Step 7:Final Accounting and Closing the EstateIn Texas the most common method to close and estate is to file a Notice of Closing Estate. The executor affirms that he/she has discharged all duties and all known debts have been paid or settled. Selling an Estate HomeWhat are some of the duties of the Executor when selling a house?

If you have been appointed the Executor of an estate you should consult a board certified Estate attorney. That notwithstanding here are some of the duties and responsibilities you will be charged with once the probate court has ruled the will is valid and you are selected the Executor as it relates to real property: · Notify all heirs and other interested parties if and when you plan to put the house up for sale. · Obtaining an accurate “fair market value” of the house from an independent party such as a licensed residential appraiser or with the help of a real estate agent. You must secure the home, maintain and keep it insured. · Filing the petition to sell the probate house with the courts Selling an Estate Home in El Paso

|

ResourcesEl Paso Estate Sales& Auctions -Certified Appraisers Guild of America 915-525-3474 Downloads

| ||||||